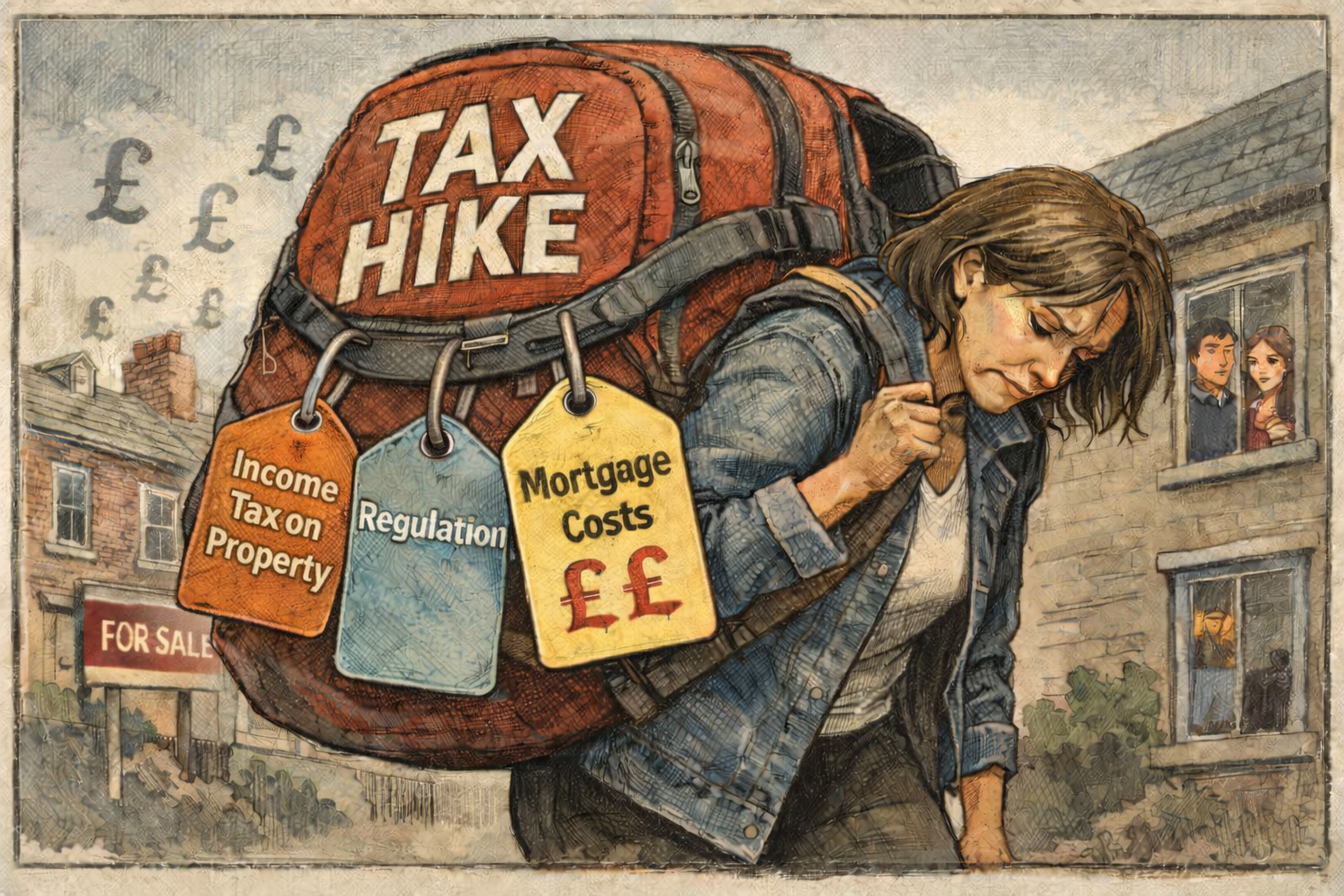

Budget impact on landlords

Research suggests that landlords may be forced to raise rents to account for tax hikes announced in the Autumn Budget.

From April 2027, landlords will face a 2% tax increase on their rental income - the basic rate of property income tax will rise from 20% to 22%, while the higher rate will increase from 40% to 42%. Those paying the additional rate will pay 47%.

Get mortgage-ready this year

Hoping to move or remortgage this year? Here’s how to get mortgage-ready in 2026.

Review your finances

Now that the busy festive period is over, why not take this opportunity to organise your finances. Go through your bank statements and identify where you can reduce your spending – not only will this help you save for a deposit, but it will make your mortgage application stronger in the eyes of a lender.

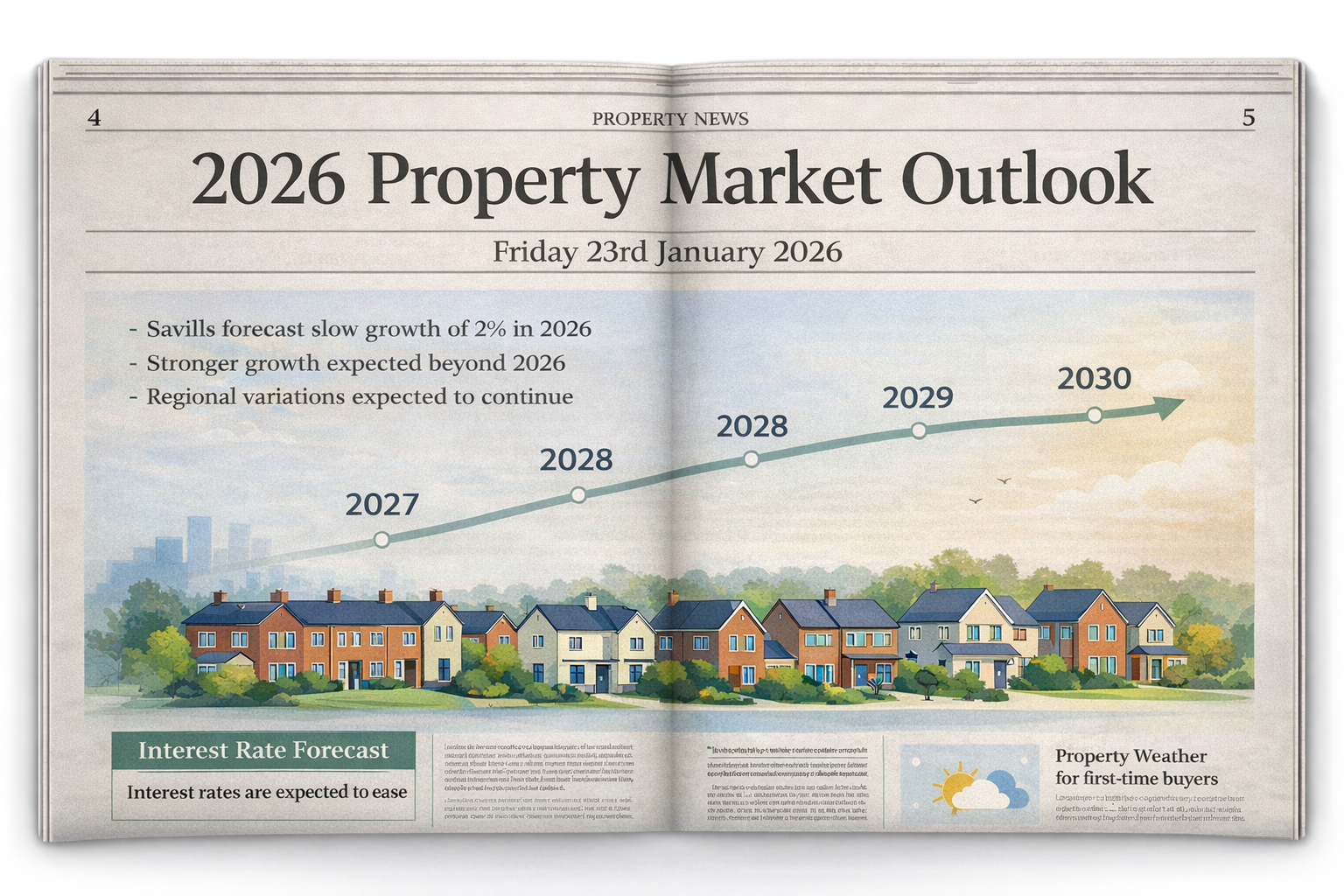

2026 property market outlook

The start of a new year often prompts people to review their plans and for many, that might include a resolution to move home. As market conditions continue to evolve, prospective buyers and sellers might be wondering what will happen with property prices in 2026 and beyond.

What buyers are looking for

A survey from LRG has revealed the three most influential factors when buying a property, excluding price and location.

Updated kitchens and bathrooms were the important features, with 77% of respondents citing these as key influencers.

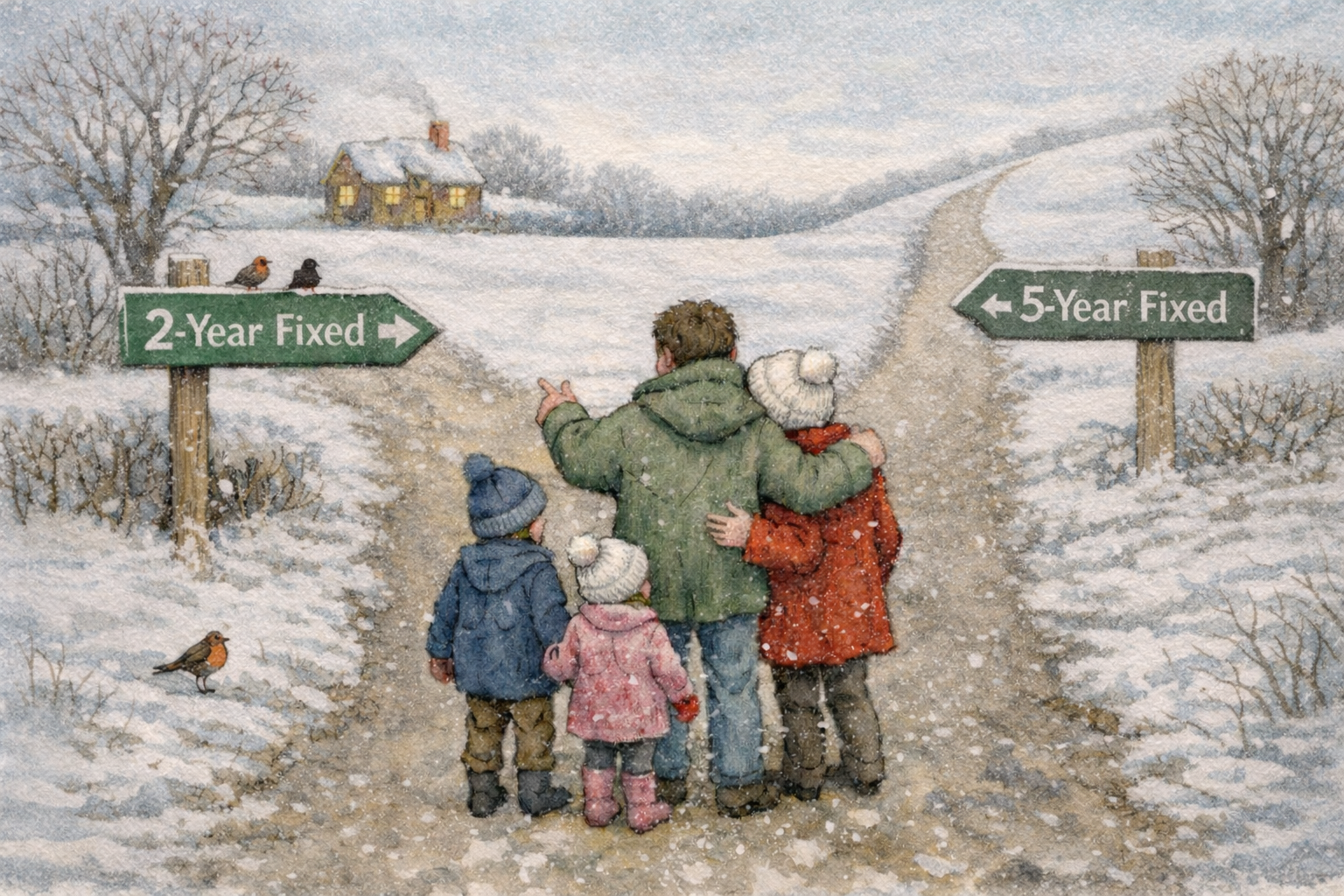

Borrowers favour a shorter fixed rate period

Data from the Bank of England shows that UK borrowers are currently favouring two-year fixed-rate deals.

In Q2 of this year, half of new mortgages were two-year deals, with only 35% opting for five-year terms. Borrowers are probably hoping to remortgage to a cheaper deal if Bank Rate keeps falling over the next two years.

Predictions for house price growth

Savills has published its latest five-year outlook for the UK housing market, including predictions for house price growth between now and 2030.

The report predicts that house price growth will be subdued in the short term, with the average home expected to rise in value by just 1.0% in 2025 and 2.0% in 2026. This slow pace is due to ongoing uncertainty about the economy and weak demand from buyers.

FTBs prioritise ‘forever homes’

New data indicates that first-time buyers (FTBs) are taking out longer mortgages to help them move straight into their ‘forever home’.

In August, a third (33.5%) of FTBs bought a semi-detached property, up 1.7% when compared with the same month in 2024. Meanwhile, only 19% purchased a flat, representing a 2.7% annual decline.

Renovation over relocation

Millions of UK homeowners are choosing to renovate their existing home instead of moving.

In England and Wales, about 1.7 million homes (one in 15 properties) have undergone significant renovation work. These homes are marked with ‘official improvement indicators’, showing that they have had major structural changes, such as an extension or loft conversion. Legally, Council Tax cannot be increased on homes with improvement indicators until the property is sold or there is a general revaluation of all domestic properties.

Mortgage payments reach record high

Data from the Office of National Statistics shows that the average monthly mortgage repayment has surpassed £1,000 for the first time on record.

In August, the typical monthly payment reached £1,002.27, indicating that, despite some cuts to Bank Rate over the last year, homeowners are still facing affordability challenges due to higher inflation. Less than a year ago, average repayments were below £950 and, in 2020, homeowners were paying an average of £680 per month. This sharp increase shows how much borrowing costs have risen in the last five years.

More FTBs using LISAs to buy home

Data shows that the number of people buying a home with a Lifetime ISA (known as LISA) increased in the 2024/25 tax year.

According to the statistics, 82,750 account holders withdrew money from their LISA to buy their first home, which is about 30,500 more than in the previous tax year.

Best commuter towns revealed

Research has revealed the best UK commuter towns, offering lower house prices whilst being in proximity to major cities.

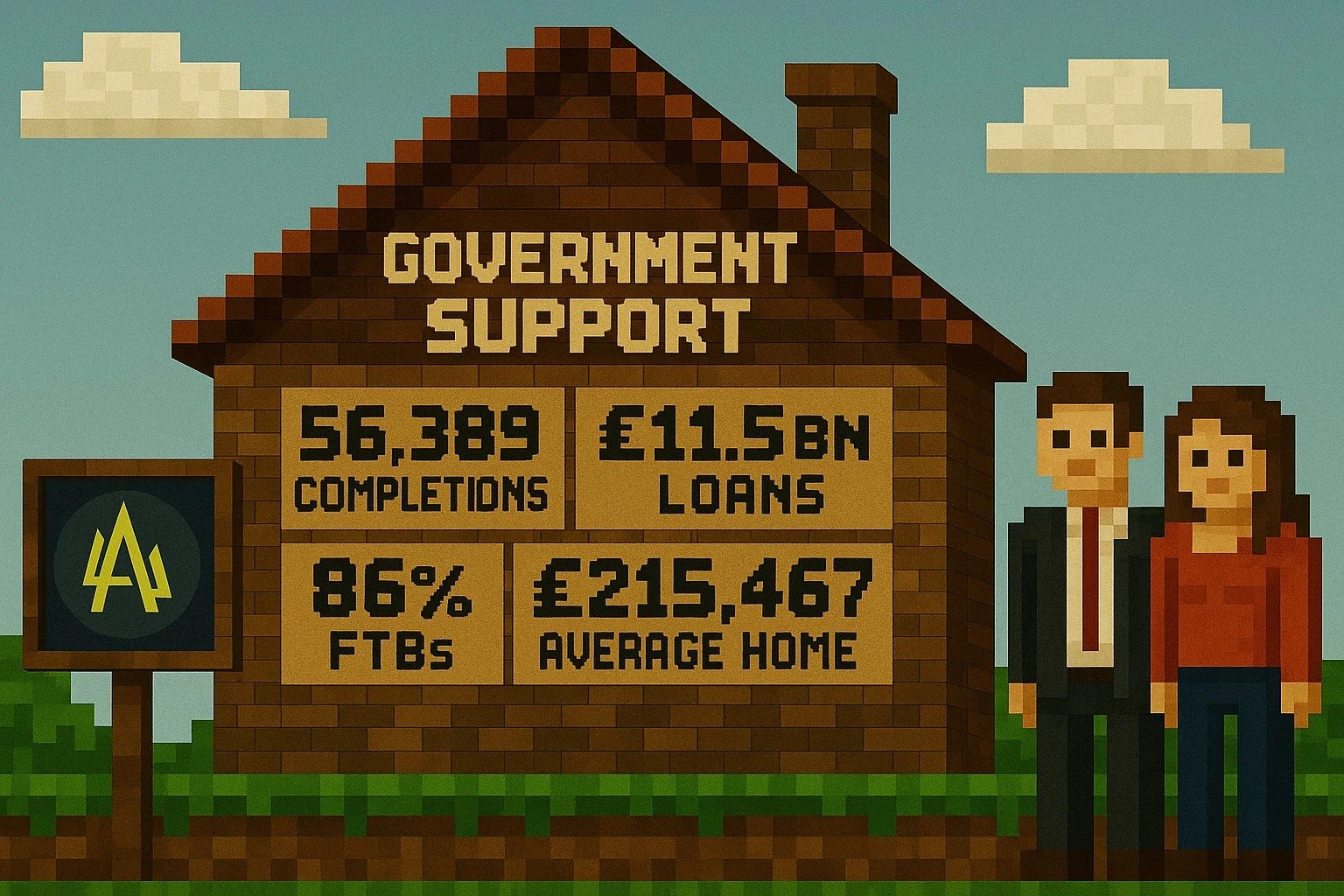

Buyers supported by government scheme

In July, the Labour government’s permanent Mortgage Guarantee Scheme became available, after the previous iteration supported over 56,000 mortgage completions.

The old scheme, which ran from April 2021 to March 2025, was launched by Boris Johnson’s Conservative government. It helped 56,389 people to access mortgages with smaller deposits, with 3,180 completions in Q1 of this year.

Is your mortgage deal coming to an end?

Over 760,000 borrowers will be considering their mortgage options as their fixed-rate deals come to an end this year.

Those with five-year deals about to expire may be anticipating sharp rises in their monthly bills; they will have fixed their mortgage in 2020, when interest rates were as low as 1.4%. Since then, rates have soared, meaning payments could increase by up to £300 a month.

FTBs making smart sacrifices

A survey of homeowners has highlighted the savvy behaviours of today’s first-time buyers (FTBs).

The report found that over half of FTBs are opting to buy a studio flat or a home with one or two bedrooms.

Homebuyers warned about Stamp Duty scams

HMRC has warned buyers to be cautious of tax agents making false claims about Stamp Duty Land Tax (SDLT).

Some homeowners have been wrongly advised that properties in need of repair are uninhabitable, so are eligible for non-residential rates of SDLT. Rogue agents are suggesting that, for a fee, they can secure a tax refund on behalf of the buyer.

House prices outstrip wage growth

Over the last year, house prices have increased 5.3 times faster than the rate of earnings.

The average house price has increased by £10,087 to £271,403. However, the typical annual salary has only gone up by £1,921 to £40,334. The East of England and the East Midlands have experienced the most significant disparity, with house prices outstripping earnings by 6.7 times. Scotland (6.4 times), Wales (6.3 times) and Yorkshire and the Humber were also significantly affected (5.8 times).

The nation is confused by leaseholding

If you find it difficult to understand leasehold and freehold, you’re not alone.

Research has found that leasehold is the UK’s most confusing property term, with the term generating over 160,000 Google searches in the last year. Freehold was second on the list, accounting for 114,000 searches.

A busy summer for housing

It was a busy summer of news for the housing market – here’s what you need to know.

In August, the Bank of England (BoE) reduced Bank Rate from 4.25% to 4%. This is the lowest level in two years and the fifth cut since August 2024. However, the decision wasn’t straightforward as the Monetary Policy Committee (MPC) required two rounds of votes to reach a majority. Ultimately, five members were in favour of lowering the rate, while four wanted to hold it at 4.25%.

How is the housing market faring so far in 2025?

House prices update

House price growth slowed to 2.1% in June, down 0.8% month-on-month. Performance varies significantly depending on the region, with Northern Ireland seeing the strongest growth of 9.7%. East Anglia was the weakest area, where house prices only increased by 1.1% annually.

Help to Buy repayments on the rise

By 2030, more than 104,000 Help to Buy accounts will reach the end of their interest-free period.

The Help to Buy scheme ran for ten years, between 2013 and 2023. Buyers of new builds were lent up to 20% (or up to 40% in London) of the property’s value as an equity loan. The loan is interest-free for five years and is repayable when the home is sold.